All Categories

Featured

Table of Contents

- – How do I apply for Real Estate Development Opp...

- – How can I secure Accredited Investor Real Esta...

- – Are there budget-friendly Real Estate Syndica...

- – What is the difference between Commercial Pro...

- – What is the most popular Accredited Investor...

- – Why should I consider investing in Real Esta...

Rehabbing a house is thought about an energetic investment approach - Accredited Investor Real Estate Syndication. You will certainly supervise of collaborating restorations, looking after contractors, and inevitably making sure the property offers. Energetic techniques call for more effort and time, though they are connected with big revenue margins. On the other hand, passive realty investing is great for capitalists that intend to take a much less engaged strategy.

With these methods, you can appreciate passive revenue with time while permitting your investments to be handled by another person (such as a residential property administration firm). The only thing to bear in mind is that you can lose on several of your returns by working with somebody else to handle the investment.

Another consideration to make when choosing a property investing method is direct vs. indirect. Similar to active vs. easy investing, straight vs. indirect describes the level of participation called for. Direct financial investments include in fact purchasing or handling residential properties, while indirect techniques are much less hands on. REIT investing or crowdfunded homes are indirect actual estate investments.

Register to attend a FREE on the internet real estate course and discover exactly how to get going investing in realty.] Numerous capitalists can get so captured up in determining a residential or commercial property kind that they don't understand where to begin when it pertains to finding an actual residential property. As you acquaint yourself with different property kinds, likewise be certain to find out where and exactly how to locate each one.

How do I apply for Real Estate Development Opportunities For Accredited Investors?

There are heaps of buildings on the marketplace that fly under the radar since financiers and homebuyers do not know where to look. Several of these homes struggle with bad or non-existent marketing, while others are overpriced when detailed and therefore failed to get any type of focus. This indicates that those investors ready to arrange via the MLS can locate a range of financial investment possibilities.

By doing this, capitalists can continually track or look out to brand-new listings in their target area. For those wondering how to make connections with property agents in their respective locations, it is a great idea to go to regional networking or real estate occasion. Capitalists looking for FSBOs will likewise discover it advantageous to collaborate with a realty agent.

How can I secure Accredited Investor Real Estate Crowdfunding quickly?

Investors can also drive with their target areas, trying to find indications to discover these residential or commercial properties. Bear in mind, identifying residential or commercial properties can require time, and capitalists ought to be ready to utilize multiple angles to secure their following bargain. For financiers living in oversaturated markets, off-market residential or commercial properties can represent a chance to prosper of the competition.

When it comes to looking for off-market homes, there are a couple of resources financiers need to inspect. These consist of public records, actual estate public auctions, dealers, networking events, and contractors.

Are there budget-friendly Real Estate Syndication For Accredited Investors options?

Years of backlogged foreclosures and raised motivation for financial institutions to retrieve could leave even much more foreclosures up for grabs in the coming months. Financiers browsing for foreclosures ought to pay mindful focus to newspaper listings and public documents to discover possible properties.

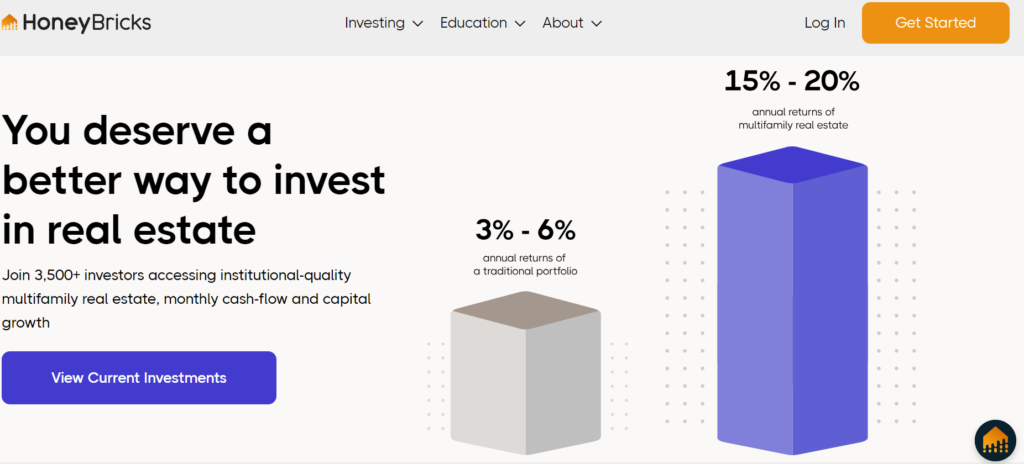

You need to consider investing in real estate after learning the numerous advantages this property has to use. Normally, the regular demand provides genuine estate reduced volatility when compared to various other financial investment types.

What is the difference between Commercial Property Investments For Accredited Investors and other investments?

The factor for this is because real estate has low relationship to other investment kinds therefore supplying some securities to financiers with various other asset types. Various sorts of realty investing are connected with various degrees of threat, so make certain to discover the best investment technique for your goals.

The procedure of acquiring property includes making a down settlement and funding the remainder of the list price. Because of this, you only spend for a tiny percentage of the building up front yet you manage the whole financial investment. This form of leverage is not readily available with other financial investment kinds, and can be used to more expand your investment portfolio.

However, as a result of the vast variety of alternatives readily available, many investors most likely locate themselves wondering what actually is the very best real estate financial investment. While this is an easy concern, it does not have an easy answer. The most effective kind of financial investment property will rely on numerous factors, and investors ought to be mindful not to eliminate any kind of options when looking for possible deals.

This post explores the possibilities for non-accredited capitalists looking to endeavor into the profitable realm of property (Accredited Investor Real Estate Investment Groups). We will explore various financial investment avenues, regulative factors to consider, and approaches that equip non-accredited people to harness the capacity of property in their investment portfolios. We will also highlight how non-accredited capitalists can work to come to be accredited investors

What is the most popular Accredited Investor Rental Property Investments option in 2024?

These are normally high-net-worth individuals or business that fulfill certification demands to trade personal, riskier financial investments. Income Criteria: Individuals ought to have a yearly earnings exceeding $200,000 for 2 consecutive years, or $300,000 when combined with a spouse. Web Worth Requirement: A total assets exceeding $1 million, leaving out the key home's value.

Financial investment Understanding: A clear understanding and recognition of the threats connected with the investments they are accessing. Documents: Capacity to provide economic statements or various other documentation to validate earnings and web well worth when asked for. Realty Syndications require recognized capitalists because sponsors can just permit certified capitalists to sign up for their financial investment possibilities.

Why should I consider investing in Real Estate Investment Partnerships For Accredited Investors?

The first typical misunderstanding is when you're a recognized financier, you can maintain that status indefinitely. Certification lasts for 5 years and have to be resubmitted for authorization upon that deadline. The second misunderstanding is that you have to hit both financial criteria. To become a certified investor, one must either hit the income requirements or have the net worth demand.

REITs are eye-catching due to the fact that they generate stronger payouts than conventional stocks on the S&P 500. High yield returns Portfolio diversification High liquidity Dividends are exhausted as regular earnings Level of sensitivity to rate of interest prices Dangers associated with details homes Crowdfunding is a method of on-line fundraising that includes requesting the public to add money or startup capital for new jobs.

This permits business owners to pitch their concepts straight to daily net individuals. Crowdfunding uses the capability for non-accredited financiers to become investors in a company or in a genuine estate building they would certainly not have been able to have accessibility to without accreditation. One more advantage of crowdfunding is portfolio diversification.

In numerous instances, the investment seeker requires to have a track record and is in the infancy stage of their job. This might imply a higher danger of shedding a financial investment.

Table of Contents

- – How do I apply for Real Estate Development Opp...

- – How can I secure Accredited Investor Real Esta...

- – Are there budget-friendly Real Estate Syndica...

- – What is the difference between Commercial Pro...

- – What is the most popular Accredited Investor...

- – Why should I consider investing in Real Esta...

Latest Posts

Tax Foreclosed Home

Delinquent Irs Taxpayers List

Unpaid House Taxes

More

Latest Posts

Tax Foreclosed Home

Delinquent Irs Taxpayers List

Unpaid House Taxes