All Categories

Featured

Table of Contents

- – Are there budget-friendly Accredited Investor ...

- – How can I secure Accredited Investor Real Esta...

- – How do I exit my Accredited Investor Real Est...

- – Real Estate Investment Partnerships For Accre...

- – Accredited Investor Commercial Real Estate D...

- – Why is Accredited Investor Real Estate Platf...

Rehabbing a home is thought about an active financial investment method. On the various other hand, easy real estate investing is great for capitalists that desire to take a less engaged approach.

With these techniques, you can enjoy passive income gradually while allowing your investments to be taken care of by somebody else (such as a residential property administration firm). The only point to bear in mind is that you can lose on some of your returns by hiring somebody else to handle the financial investment.

An additional factor to consider to make when picking a real estate spending approach is direct vs. indirect. Direct financial investments entail really buying or managing homes, while indirect methods are less hands on. Numerous investors can get so caught up in identifying a residential or commercial property type that they don't know where to start when it comes to finding a real home.

Are there budget-friendly Accredited Investor Real Estate Platforms options?

There are tons of properties on the marketplace that fly under the radar because investors and homebuyers do not know where to look. Several of these residential or commercial properties struggle with inadequate or non-existent marketing, while others are overpriced when listed and consequently stopped working to obtain any attention. This means that those financiers happy to arrange with the MLS can discover a variety of investment chances.

By doing this, capitalists can constantly track or be alerted to new listings in their target area. For those asking yourself how to make connections with property agents in their respective locations, it is a great concept to go to neighborhood networking or realty occasion. Capitalists searching for FSBOs will also find it helpful to collaborate with a genuine estate representative.

How can I secure Accredited Investor Real Estate Syndication quickly?

Capitalists can likewise drive via their target areas, trying to find indications to discover these homes. Remember, determining buildings can take time, and investors must prepare to employ several angles to safeguard their next offer. For financiers staying in oversaturated markets, off-market residential properties can stand for a possibility to prosper of the competition.

When it comes to looking for off-market properties, there are a couple of resources capitalists ought to check. These include public documents, realty auctions, dealers, networking events, and contractors. Each of these sources represents an unique chance to discover properties in an offered location. For instance, wholesalers are frequently mindful of freshly rehabbed buildings offered at reasonable rates.

How do I exit my Accredited Investor Real Estate Investment Groups investment?

Years of backlogged foreclosures and raised motivation for banks to retrieve can leave also much more foreclosures up for grabs in the coming months. Investors looking for repossessions should pay mindful focus to newspaper listings and public documents to find potential properties.

You need to think about spending in genuine estate after discovering the numerous advantages this possession has to offer. Typically, the constant need offers actual estate lower volatility when compared to various other financial investment kinds.

Real Estate Investment Partnerships For Accredited Investors

The reason for this is since property has low relationship to various other investment types thus providing some protections to capitalists with other possession types. Various sorts of actual estate investing are connected with various degrees of threat, so make sure to find the ideal investment approach for your objectives.

The procedure of getting residential property involves making a down settlement and financing the remainder of the list price. As an outcome, you only pay for a small percentage of the residential or commercial property in advance yet you manage the entire investment. This kind of leverage is not readily available with other investment kinds, and can be utilized to additional expand your investment portfolio.

Nevertheless, as a result of the broad variety of choices available, several financiers likely discover themselves wondering what actually is the very best property investment. While this is a straightforward concern, it does not have an easy solution. The most effective kind of investment building will depend upon many factors, and financiers need to take care not to dismiss any type of alternatives when looking for possible bargains.

This write-up discovers the opportunities for non-accredited investors wanting to venture into the lucrative realm of actual estate (Passive Real Estate Income for Accredited Investors). We will certainly look into various financial investment methods, regulative factors to consider, and strategies that equip non-accredited individuals to harness the potential of realty in their financial investment profiles. We will likewise highlight exactly how non-accredited investors can work to end up being recognized financiers

Accredited Investor Commercial Real Estate Deals

These are typically high-net-worth people or companies that meet certification requirements to trade personal, riskier investments. Income Requirements: People need to have an annual earnings exceeding $200,000 for 2 successive years, or $300,000 when integrated with a spouse. Net Worth Demand: A total assets exceeding $1 million, excluding the key house's value.

Investment Understanding: A clear understanding and awareness of the risks related to the investments they are accessing. Documentation: Ability to give monetary declarations or various other documents to confirm earnings and web well worth when requested. Real Estate Syndications need recognized investors because sponsors can just permit accredited investors to sign up for their financial investment possibilities.

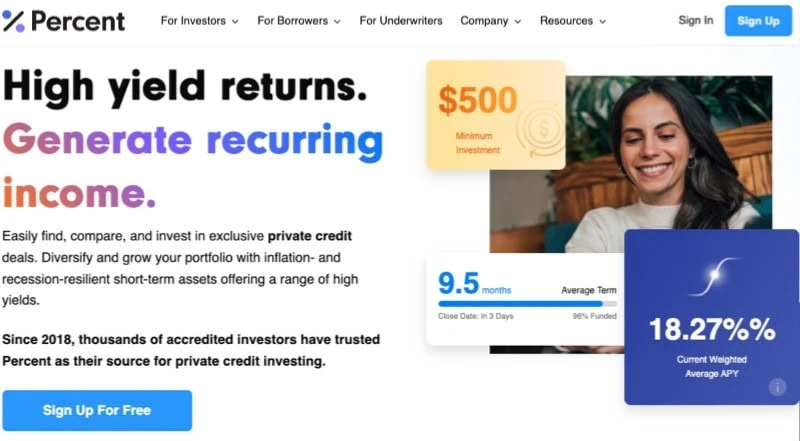

Why is Accredited Investor Real Estate Platforms a good choice for accredited investors?

The first typical false impression is as soon as you're an accredited capitalist, you can keep that status indefinitely. To come to be an accredited capitalist, one must either strike the revenue criteria or have the web worth need.

REITs are appealing because they produce more powerful payouts than traditional stocks on the S&P 500. High return rewards Portfolio diversification High liquidity Returns are exhausted as average earnings Level of sensitivity to rate of interest prices Risks related to particular properties Crowdfunding is an approach of online fundraising that includes asking for the general public to add cash or startup capital for brand-new projects.

This enables business owners to pitch their ideas straight to day-to-day internet customers. Crowdfunding offers the ability for non-accredited investors to come to be shareholders in a firm or in a realty residential property they would not have had the ability to have access to without accreditation. One more benefit of crowdfunding is profile diversity.

The third benefit is that there is a reduced barrier to entrance. Sometimes, the minimum is $1,000 dollars to purchase a firm. In lots of situations, the financial investment candidate needs to have a record and remains in the infancy phase of their task. This could mean a greater threat of losing a financial investment.

Table of Contents

- – Are there budget-friendly Accredited Investor ...

- – How can I secure Accredited Investor Real Esta...

- – How do I exit my Accredited Investor Real Est...

- – Real Estate Investment Partnerships For Accre...

- – Accredited Investor Commercial Real Estate D...

- – Why is Accredited Investor Real Estate Platf...

Latest Posts

Tax Foreclosed Home

Delinquent Irs Taxpayers List

Unpaid House Taxes

More

Latest Posts

Tax Foreclosed Home

Delinquent Irs Taxpayers List

Unpaid House Taxes