All Categories

Featured

Table of Contents

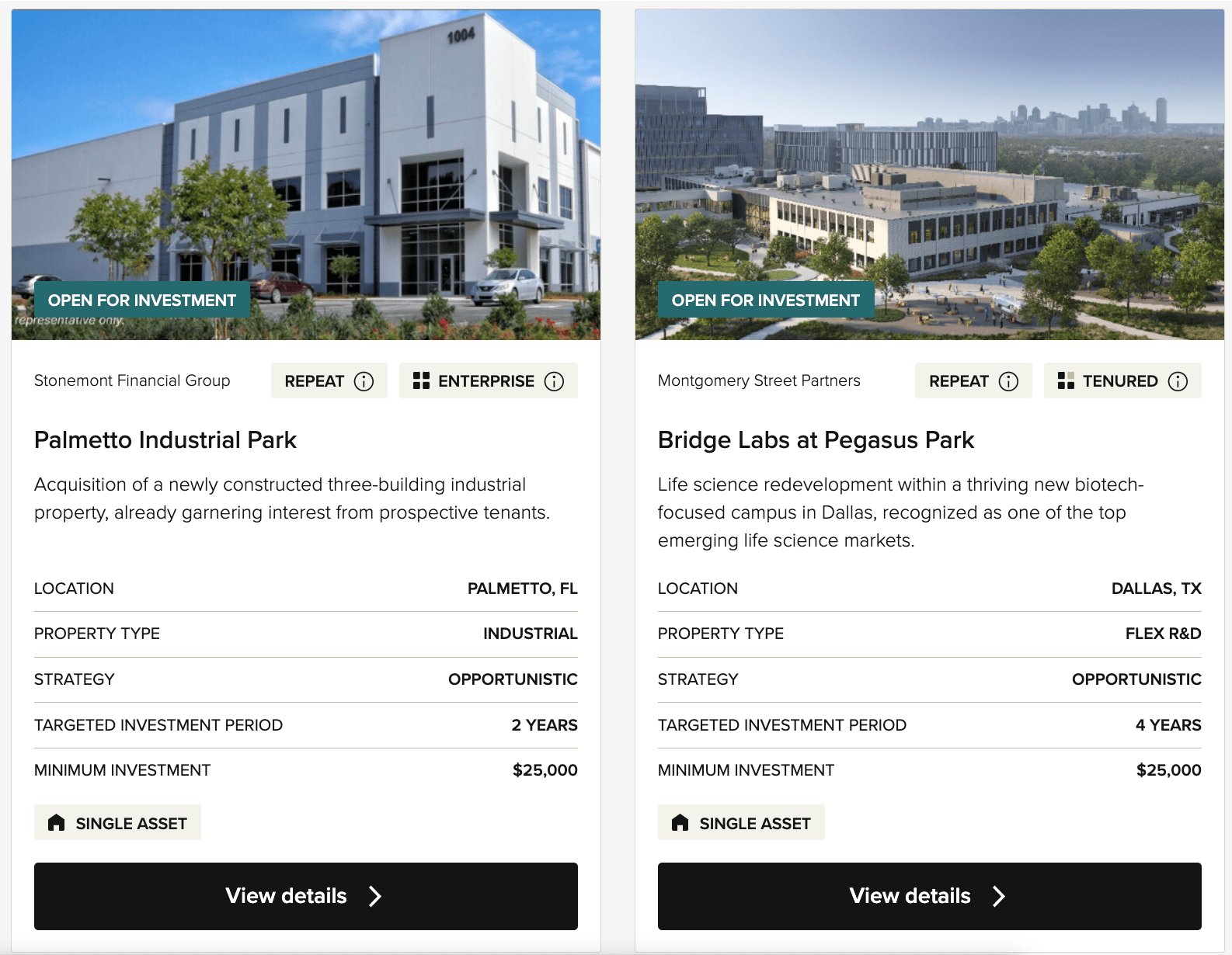

The rest of their industrial real estate deals are for accredited investors just. VNQ by Lead is one of the biggest and well understood REITs.

Their number one holding is the Lead Property II Index Fund, which is itself a mutual fund that holds a range of REITs. There are other REITs like O and OHI which I am a long-time investor of. REITs are a very easy method to gain real estate direct exposure, but it does not have the exact same amount of focus as eREITs and individual commercial realty deals.

To be an accredited capitalist, you have to have $200,000 in yearly earnings ($300,000 for joint investors) for the last two years with the assumption that you'll gain the exact same or extra this year. You can additionally be considered a recognized capitalist if you have an internet well worth over $1,000,000, independently or collectively, excluding their main residence.

What are the top Real Estate Investment Networks For Accredited Investors providers for accredited investors?

These deals are commonly called exclusive positionings and they do not require to sign up with the SEC, so they do not give as much information as you would certainly get out of, state, a publicly traded business. The certified investor demand presumes that a person that is accredited can do the due persistance on their very own.

You simply self-accredit based on your word., making it easier for even more individuals to certify. I think there will be continued movement away from high cost of living cities to the heartland cities due to set you back and technology.

It's all about adhering to the money. Both are totally free to sign up and discover.

Below is my property crowdfunding dashboard. If you want to find out more about real estate crowdfunding, you can see my actual estate crowdfunding discovering center. Sam functioned in spending financial for 13 years. He obtained his bachelor's degree in Business economics from The University of William & Mary and got his MBA from UC Berkeley.

He hangs around playing tennis and looking after his family members. Financial Samurai was started in 2009 and is one of one of the most trusted individual money sites on the internet with over 1.5 million pageviews a month.

Key Takeaways What are considered the most effective realty financial investments? With the U.S. property market on the surge, investors are sifting through every offered building kind to discover which will help them revenue. Which sectors and residential properties are the finest relocations for financiers today? Keep reading to get more information about the ideal type of genuine estate investment for you.

Can I apply for Accredited Investor Real Estate Crowdfunding as an accredited investor?

Each of these types will feature unique advantages and downsides that investors must evaluate. Allow's check out each of the choices offered: Residential Realty Commercial Real Estate Raw Land & New Construction Real Estate Investment Depends On (REITs) Crowdfunding Systems Register to participate in a FREE online property course and discover how to begin purchasing property.

Various other homes include duplexes, multifamily properties, and trip homes. Residential actual estate is excellent for numerous financiers because it can be less complicated to turn earnings regularly. Certainly, there are lots of property realty investing techniques to deploy and various degrees of competition across markets what may be right for one investor may not be best for the following.

What is a simple explanation of Accredited Investor Real Estate Investment Groups?

The very best industrial homes to buy consist of commercial, workplace, retail, hospitality, and multifamily jobs. For financiers with a solid concentrate on enhancing their regional communities, business real estate investing can sustain that emphasis (Accredited Investor Commercial Real Estate Deals). One reason commercial properties are thought about among the very best kinds of realty investments is the possibility for greater cash flow

To get more information about getting going in , be sure to review this article. Raw land investing and brand-new building stand for 2 sorts of property investments that can diversify a financier's profile. Raw land describes any uninhabited land available for acquisition and is most attractive in markets with high predicted growth.

Investing in brand-new building and construction is additionally preferred in swiftly expanding markets. While many capitalists may be unfamiliar with raw land and new construction investing, these investment types can represent attractive revenues for financiers. Whether you are interested in developing a property from beginning to end or benefiting from a long-term buy and hold, raw land and brand-new construction provide a distinct opportunity to investor.

How do I exit my Accredited Investor Real Estate Deals investment?

This will certainly ensure you select a preferable location and avoid the investment from being obstructed by market factors. Property investment company or REITs are companies that have various industrial real estate kinds, such as hotels, stores, workplaces, shopping centers, or restaurants. You can spend in shares of these property business on the supply exchange.

It is a requirement for REITs to return 90% of their taxed earnings to shareholders yearly. This provides financiers to get dividends while diversifying their profile at the same time. Publicly traded REITs additionally provide flexible liquidity in comparison to other kinds of realty financial investments. You can market your shares of the business on the stock market when you need reserve.

While this provides the convenience of finding possessions to capitalists, this kind of real estate financial investment also presents a high quantity of danger. Crowdfunding platforms are commonly restricted to approved financiers or those with a high internet well worth.

How do I get started with Accredited Investor Real Estate Income Opportunities?

[Discovering how to invest in realty doesn't need to be tough! Our on-line actual estate spending course has every little thing you require to reduce the learning curve and start investing in property in your location.] The most effective kind of property investment will depend on your private circumstances, objectives, market area, and preferred investing strategy.

Choosing the appropriate residential property type boils down to considering each alternative's benefits and drawbacks, though there are a few crucial factors financiers must remember as they look for the most effective option. When picking the finest sort of investment home, the value of area can not be downplayed. Financiers operating in "up-and-coming" markets may discover success with uninhabited land or new construction, while capitalists operating in more "mature" markets may want properties.

Analyze your preferred level of involvement, risk resistance, and success as you decide which residential or commercial property kind to invest in. Investors wishing to take on a much more passive role might decide for buy and hold commercial or homes and employ a residential property supervisor. Those wishing to take on a much more active function, on the various other hand, might locate creating vacant land or rehabbing residential homes to be much more satisfying.

Table of Contents

Latest Posts

Tax Foreclosed Home

Delinquent Irs Taxpayers List

Unpaid House Taxes

More

Latest Posts

Tax Foreclosed Home

Delinquent Irs Taxpayers List

Unpaid House Taxes